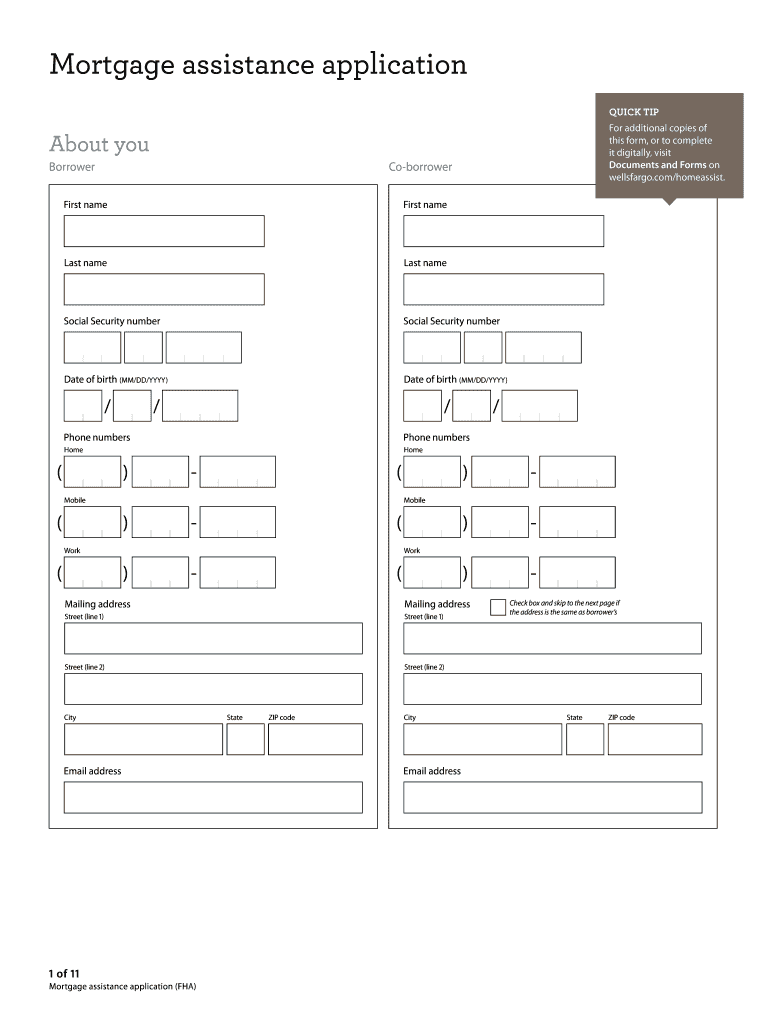

Wells Fargo Mortgage Assistance Application 2016-2026 free printable template

Show details

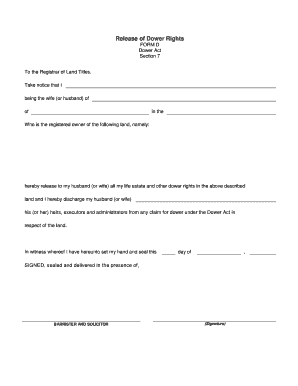

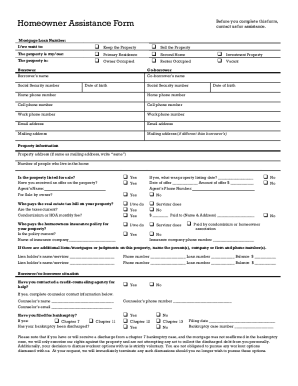

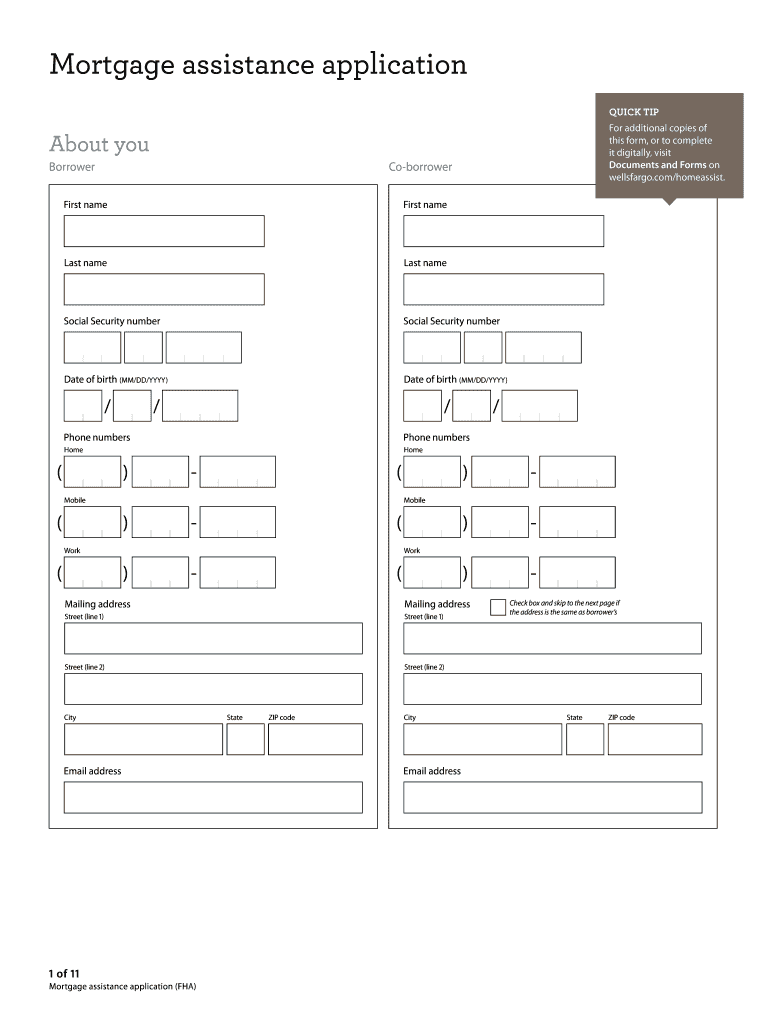

Mortgage assistance application QUICK TIP For additional copies of this form or to complete it digitally visit Documents and Forms on wellsfargo. Long term or permanent hardship 12 months Natural or man-made disaster adversely impacting the property or place of employment Business failure or decline in business earnings Divorce or legal separation or separation unrelated by marriage civil union or similar domestic partnership under applicable law or serious illness affecting us or a dependent...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign mortgage assistance application get form

Edit your mortgage assistance application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage assistance application form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing wells fargo mortgage phone number online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit mortgage assistance application pdf form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage assistance application online form

How to fill out Wells Fargo Mortgage Assistance Application

01

Gather all necessary documentation, including proof of income, tax returns, and mortgage statements.

02

Visit the Wells Fargo website and navigate to the Mortgage Assistance section.

03

Download or request the Mortgage Assistance Application form.

04

Fill out the application form with your personal information, including your contact details, income, and loan information.

05

Provide a detailed explanation of your financial hardship and the assistance you require.

06

Attach the required documentation to your application.

07

Review your application for accuracy and completeness.

08

Submit the application either online or by mailing it to the designated address provided.

Who needs Wells Fargo Mortgage Assistance Application?

01

Homeowners who are experiencing financial difficulties and are unable to make their mortgage payments.

02

Individuals who have lost their job, faced medical emergencies, or encountered other financial hardships.

03

Those who are at risk of foreclosure and are seeking assistance to modify or refinance their mortgage.

Fill

mortgage assistance application blank

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete wells fargo hardship assistance form online?

Completing and signing mortgage assistance application printable online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I complete mortgage assistance application wells fargo on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your loan form documents. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

How do I complete mortgage assistance application latest on an Android device?

Complete loan documents forms and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is Wells Fargo Mortgage Assistance Application?

The Wells Fargo Mortgage Assistance Application is a form that homeowners can complete to request assistance with their mortgage payments, offering options for loan modification or other forms of relief.

Who is required to file Wells Fargo Mortgage Assistance Application?

Homeowners who are experiencing financial hardship and are unable to make their mortgage payments are required to file the Wells Fargo Mortgage Assistance Application to seek help.

How to fill out Wells Fargo Mortgage Assistance Application?

To fill out the Wells Fargo Mortgage Assistance Application, homeowners should provide accurate personal information, financial details, and relevant documents such as income verification and hardship statements, ensuring all sections are completed.

What is the purpose of Wells Fargo Mortgage Assistance Application?

The purpose of the Wells Fargo Mortgage Assistance Application is to evaluate a homeowner's financial situation and determine eligibility for various mortgage relief options to prevent foreclosure.

What information must be reported on Wells Fargo Mortgage Assistance Application?

The Wells Fargo Mortgage Assistance Application requires reporting information such as the homeowner's income, expenses, loan details, reasons for the financial hardship, and any supporting documents that validate the request for assistance.

Fill out your Wells Fargo Mortgage Assistance Application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Assistance Application Fill is not the form you're looking for?Search for another form here.

Keywords relevant to mortgage assistance application fillable

Related to mortgage fargo form printable

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.