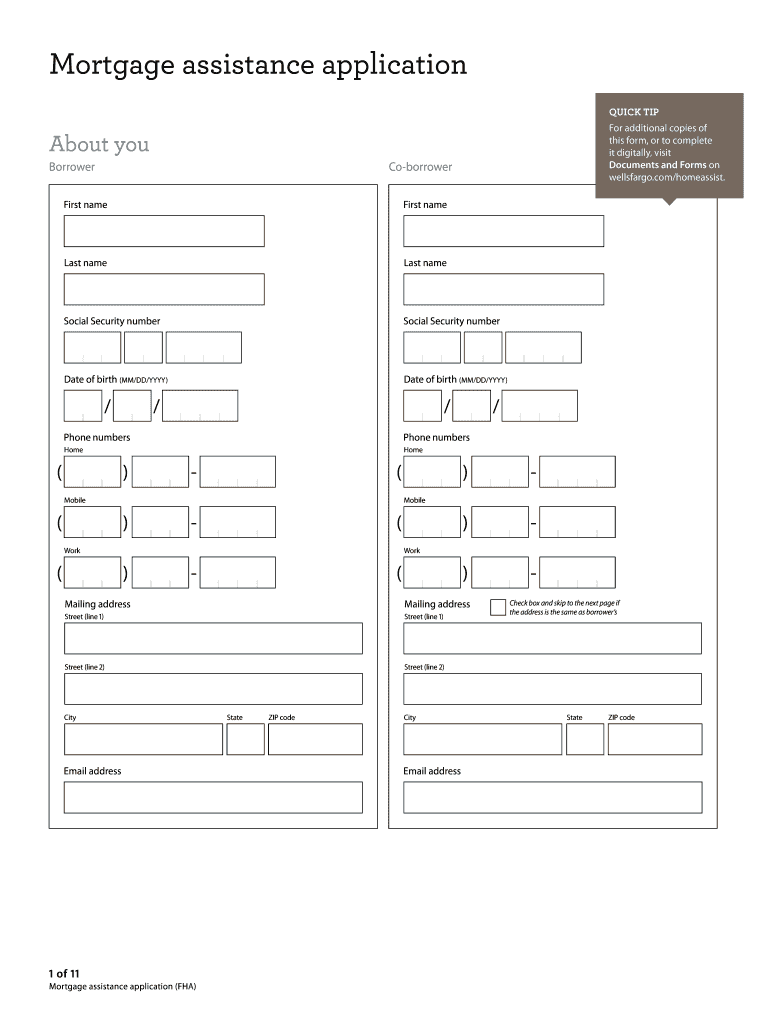

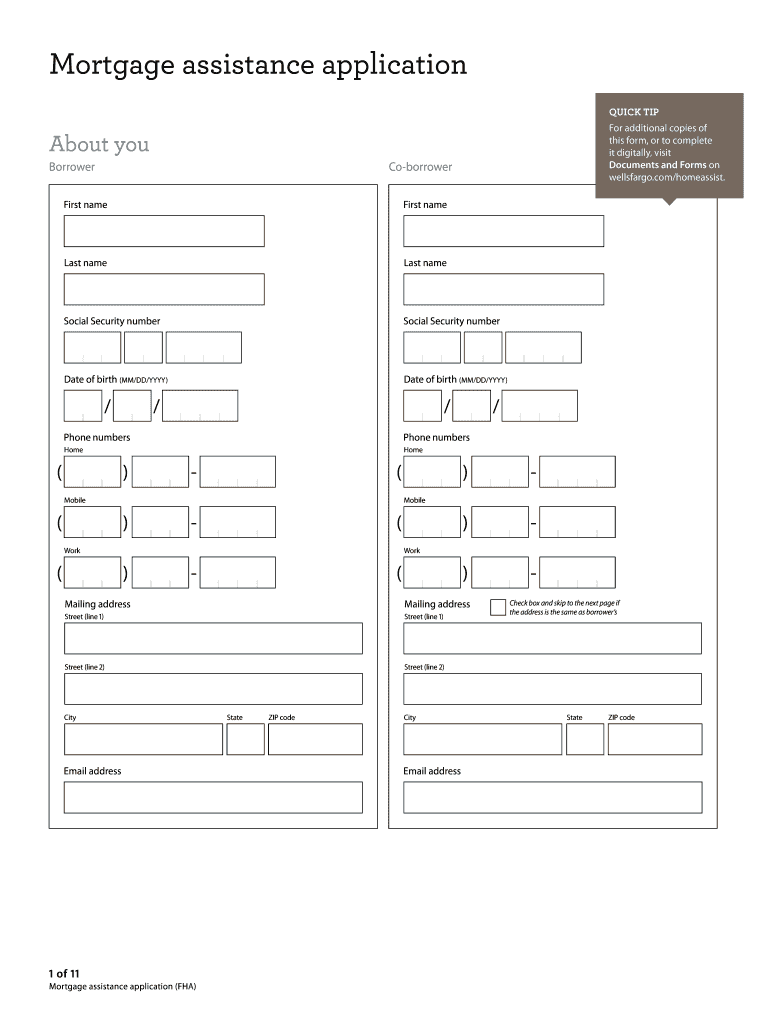

Wells Fargo Mortgage Assistance Application 2016-2024 free printable template

Get, Create, Make and Sign

Editing mortgage assistance application online

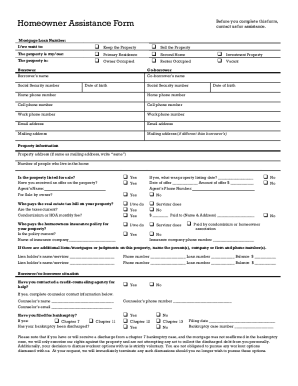

How to fill out mortgage assistance application form

How to fill out a mortgage assistance application:

Who needs a mortgage assistance application:

Video instructions and help with filling out and completing mortgage assistance application

Instructions and Help about loan documents forms

FIRST FEMALE DIRECTOR IN HISTORY AT THE CIA WE WILL KEEP AN EYE ON THIS AND BRING YOU RESULTS AFTER THE VOTING WRAPS UP ANOTHER DAY ANOTHER HIT TO THE LATEST EMPLOYEES FROM WELLS ARGOS UNIT THAT DEALS WITH BUSINESS NOT CONSUMER APPARENTLY ALTERED INFORMATION RELATED TO CORPORATE CUSTOMERS EVERYTHING FROM SOCIAL SECURITY NUMBERS TO OTHER IDENTIFIERS THIS AFTER MULTIPLE SCANDALS AND SANCTIONS AND PENALTIES FOR ALL KINDS OF OTHER ISSUES WHAT IS GOING ON WITH THIS COMPANY AND THE STOCK SHOULD BE IN YOUR PORTFOLIO YOU WATCHED THE REASON WE LIKE YOU HERE Is that YOU WATCH FROM A REGULATORY STANDPOINT I WOULD THINK THIS IS TOXIC FOR THEM BUT YOU SAY WHAT I'm POSITIVE ON WELLS FARGO TO BUT NOT BECAUSE THEY'RE DOING A GREAT JOB BUT BECAUSE THE ASSETS ARE CAPPED WITH THE AGREEMENT WITH THE FEDERAL RESERVE ALL THE EARNINGS THEY HAVE TO RETURN IT IN SOME WAY SHAPE OR FORM WHAT YOU MEAN CAP THE FED CAPPED WELLS ARGOS ABILITY TO GROW DUE TO INADEQUATE RISK CONTROL THAT WAS AN UNPRECEDENTED SMACK DOWN OF A US BANK IT CERTAINLY WAS AND WELL-DESERVED TODAYS EVENTS SHOW THAT TODAYS EVENTS SHOW THAT THE STOCK IS DOWN ANOTHER ONE AND TWO THIRDS PERCENT THIS IS LIKE DEATH BY A THOUSAND VIOLATIONS BUT THEY WILL STILL EARN 22 OR 23 BILLION A YEAR END THEY Can't GROW SO WHAT DO THEY DO WITH THOSE EARNINGS LETS TALK ABOUT WHAT THEY DID THIS TIME AROUND BY THE WAY WELLS FARGO REPORTED THIS THEY DISCOVERED IT AND REPORTED IT FOR THE ALTERED INFORMATION ON BUSINESS MONEY LAUNDERING DEADLINE THEY WERE SUPPOSED TO REACH YES IS AT THE WORST THING IN THE WORLD DID THEY PUT FAKE INFORMATION LIKE THEY DID WITH MORE THAN 3 MILLION CONSUMER ACCOUNTS TWO YEARS AGO SO THAT'S UNCLEAR BUT IT DOESN'T APPEAR TO BE FAKE INFORMATION IT APPEARS THEY WERE USING OTHER SOURCES OF INFORMATION AS OPPOSED TO GOING TO THE CLIENT AND GETTING THE INFORMATION THEY THEN ADDED IT TO THE DOCUMENTS THEY HAD IN ORDER TO MEET THE DEADLINE THEY WERE TRADING INFORMATION OR CREATING INFORMATION THE INFORMATION THEY HAD MAY HAVE BEEN STALEMATE OR DATED ARE BLANK HAVE BEEN STALEMATE OR DATE DARE BLANK SO THEY GOT IT AS OPPOSED TO GOING TO THE CLIENT THEY WENT TO OLDER DOCUMENTS AND PEOPLE IN SOURCE INFORMATION THAT'S THE AIR ON THEIR BEHALF WE HAD A WELLS FARGO SHAREHOLDER WHO IS ALSO AN ACTIVIST PRINT HE WAS KICKED OUT OF THE SHAREHOLDER MEETING LAST YEAR FOR PRESSING THE BOARD ON WHAT THEY WERE GOING TO DO TO PREVENT THESE KINDS OF SCANDALS HE WAS LITERALLY DRAGGED OUT OF THAT MEETING HE TOLD US THE WELLS FARGO BRING BING BRIG BRING THAT STAGECOACH BRAND IS BEING BURNED TO THE GROUND BY THESE ISSUES THE ANNUAL HIGH OF THE STOCK WAS 6631 PRETTY CAN SEE RIGHT NOW ITS 5408 THAT'S NOT THE BIGGEST DROP AND CERTAINLY NOT A TWO-WEEK LOW BUT IF I'm AN INVESTOR AND CERTAINLY NOT A TWO WEEKLY BUT IF I'm AN INVESTOR DO I REALLY WANT TO PUT THIS IN MY PORTFOLIO RIGHT NOW OR DO I WAIT UNTIL ALL OF THESE ISSUES SHAKEOUT QUESTION THAT THAT'S A GREAT QUESTION WE DON'T KNOW HOW MANY ISSUES THERE ARE SEEMS TO BE WEEKLY OR...

Fill assistance application fargo : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your mortgage assistance application form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.